Location Reputation of Regional Tire Dealers

If you’re like most business owners, you take your brand’s reputation seriously. In today’s digital age, negative online reviews can damage your business’ reputation. So, it’s important to know how your business is perceived by local consumers. In this Network Insight post we’ll take a look at the components of the local reputation of regional tire dealers.

While the star rating is the number one factor consumers use to judge a business, many other factors are also influential to consumer choice. These factors include:

- Number of Reviews: People trust ratings when they are based on multiple reviews. This comes into play in three ways: a) people discount ratings based on very few reviews, b) people gravitate toward locations with good ratings and many reviews and c) people shy away from locations with poor ratings (< 3) and many reviews

- Recency: Prospective customers look for recent reviews to ensure the review may be relevant to their experience. Ideally a location has a review within the last month for people to have confidence in its relevance. Locations with reviews that are a few months old are viewed neutrally, while if a location’s most recent review approaches a year or more old consumers will discount that experience.

- Negativity: Negative reviews catch the eye of prospective customers. When looking at a location people tend to forgive a location that may have a bad review shown near the top of the list, but if there are multiple bad reviews people are likely to assume that will be their experience.

- Rating Trend: Consumers will look favorably on a location where the reviews appear to be trending upwards. For example a location with a < 4-star rating that shows all 5-star reviews at the top of the list will get a boost in the consumer’s eye.

We used the Influence Network review monitoring and analysis platform to scan the Google Maps pages of over 1300 locations for 17 regional tire and auto service companies and determined the Influence Network Score™ for each individual location based on the criteria above. This score is then used to assign a Reputation Health Rating rating of each location, which represents the overall appeal and influence of the rating and reviews for that respective location to a prospective customer. These range from:

- Healthy (a score of 93 and above): Strong characteristics across all dimensions – including high rating, frequent reviews, high review count and few negative reviews shown in the location’s summary.

- Needs Work (a score 76 and 92): Strong characteristics in many dimensions – however has some weakness in one or two of the elements analyzed.

- Poor (a score of 75 or below): Weak in many elements analyzed typically including poor ratings, infrequent reviews and higher number of negative reviews in the location’s summary.

Industry Summary

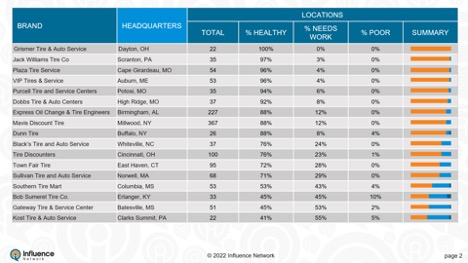

The chart below, sorted from best health scores to worst, provides an overview of the state of the major regional tire dealers highlighted in this report.

- Slightly more than half the stores analyzed were awarded Healthy designations, with 40% being judged as Needs Work and 6% at the bottom of the list with a Poor grade

- Chains at the top half of our scorecard have over 85% of their locations grade out in the top bucket – indicating both a strong focus on service excellence and their rating infrastructure.

- A Poor health score for a location often comes from specific, obvious but unsolved problems at that location

There is an opportunity for many brands’ overall reputation health to be improved through active review monitoring and analysis and most importantly activating consumer engagement - There is an opportunity for many brands’ overall reputation health to be improved through active review monitoring and analysis and most importantly activating consumer engagement

Ratings and reviews matter profoundly to consumers. They are a valuable tool for gauging not just how good a business is, but also whether or not they want to do business with that company. This is especially true in an age where people are more likely than ever to research a company before doing business with them. We strongly recommend that you look up the ratings of a group of your locations and compare them to your competition. If you notice that some are not up to par, it’s time to obtain a full audit across your chain and build a plan to bring all locations up to their Healthy potential.